Acquisition project | ICICI Bank Forex Card - Corporates

Elevator Pitch

Are your employees travelling abroad for business visits?

Are you looking to provide a multi-wallet forex solution to your employees?

Would you prefer to safeguard your staff against any unforeseen issues while abroad?

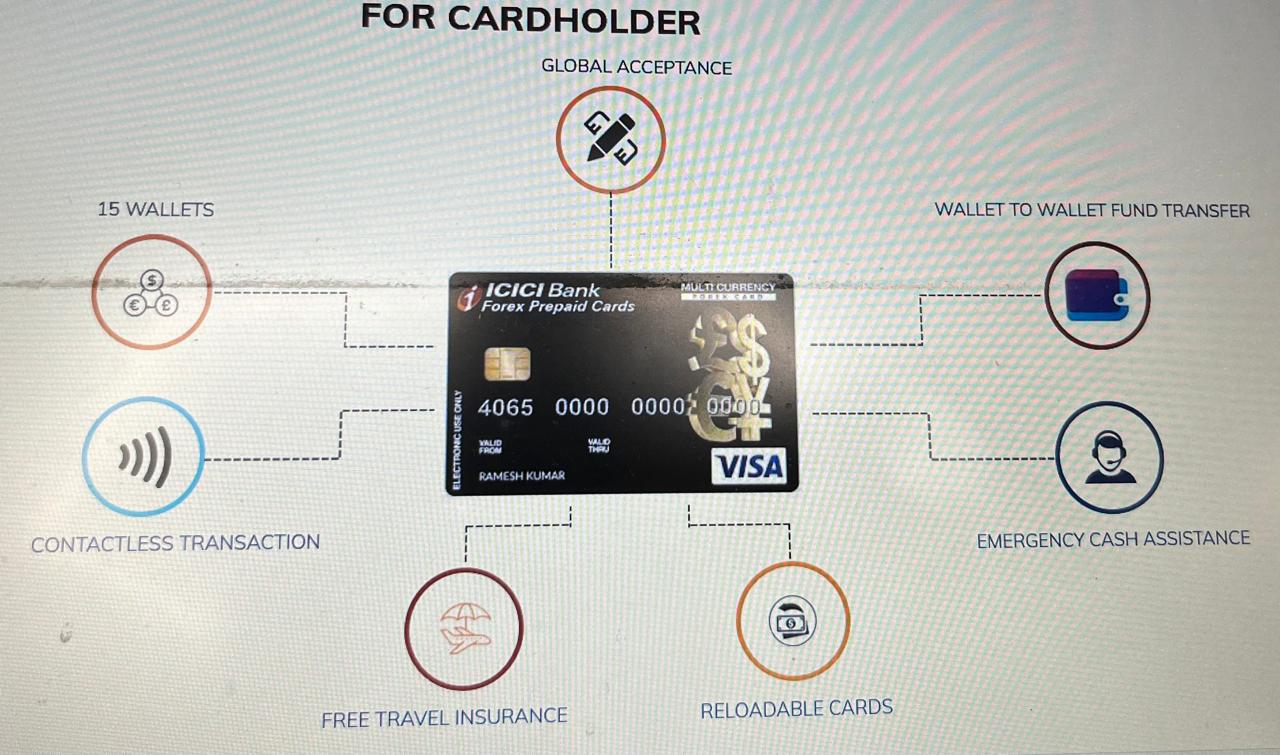

ICICI Bank Forex Prepaid Corporate Cards can be a perfect travel companion for your international business visits. Accepted globally at ATM, POS & Merchant E-com transactions, we provide convenience of carrying up to 15 currencies on a single card. Travel worry-free as our cards come with comprehensive travel insurance.

Understand your Product

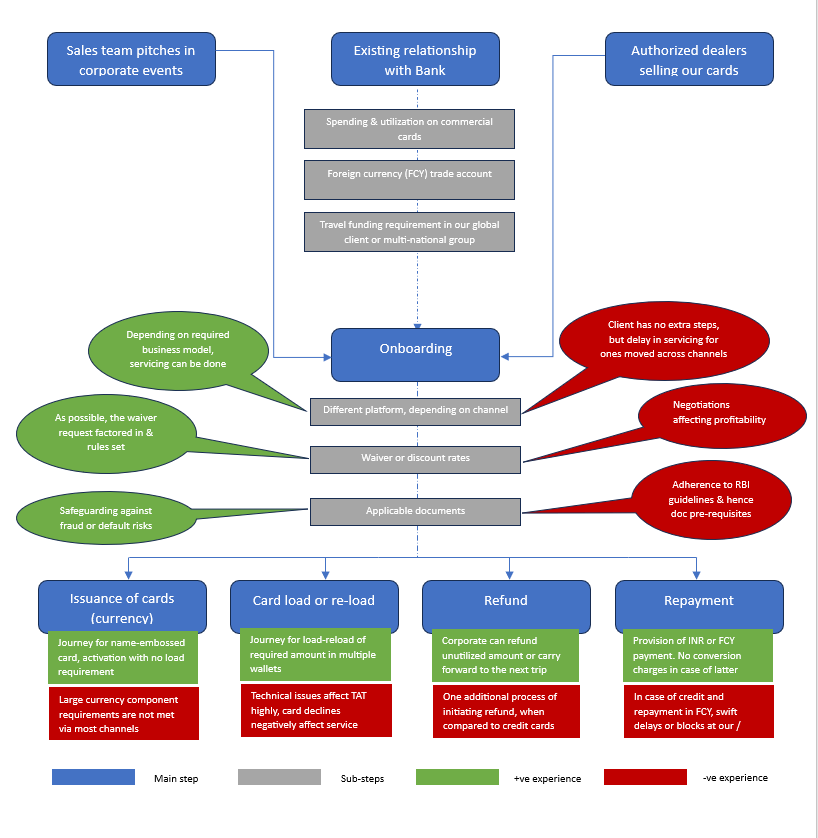

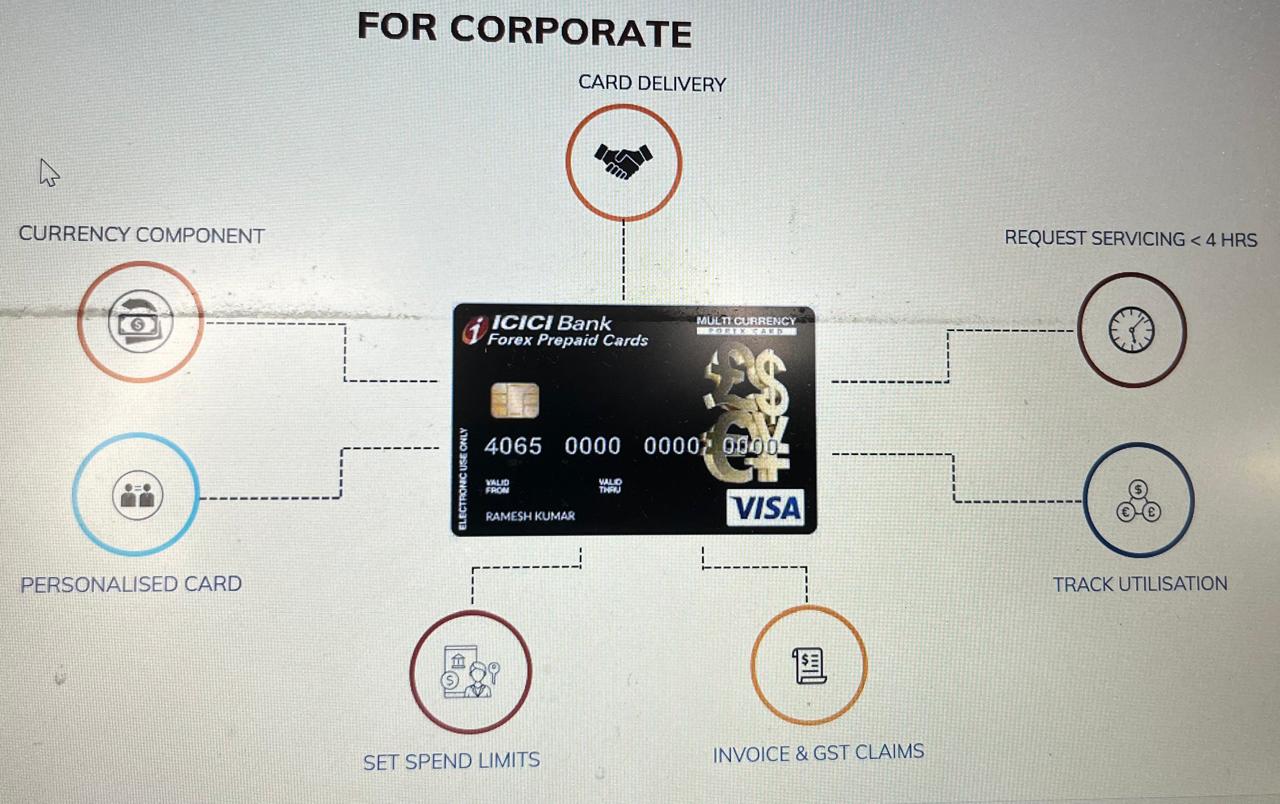

Forex corporate channel & card were specifically launched to service needs of organisations funding international travel for their employees. We wanted to provide firms (our primary client) multiple avenues of funding (on credit or via their current account), servicing (branches or doorstep delivery) & tracking of forex utilization (corporate portals to track spend, balances etc.). On the other hand, we want to provide our cardholders' (secondary clients or individuals) worry-free & comfortable travel experience, concerning foreign currency transactions.

From corporate stand-point, they want to be able to:

- Have pre-loaded cards available or delivered to staff as per their choice

- Have a request serviced for card loading & delivery within a day

- Track utilization & place reload requests (or approve the ones placed by staff), when the staff are abroad,

- Access invoices & claim GST, wherever applicable

- See wallet balances and place refund requests, after the staff have returned

- Provide staff avenues to manage applicable card controls, initiate loading request, raise disputes if any, access helpline or assistance services if required

- Set daily spend limit, if required

- Provide name-embossed (cardholder & corporate) cards wherever required

- Have currency bundled with card for staff, as safety net

From the perspective of cardholder, they want to be able to:

- Use the card to cover all their spends (i.e., there should not be problems with card acceptance)

- Track personal utilization & place reload request

- Carry cash & withdraw subsequently

- Get assistance easily in the event of any fraud

- Transfer between the wallets

- Manage card controls anytime

- Get transaction alerts (Confirmation of successful transactions, but more importantly to know immediately if there is any unauthorised transaction)

Both the entities expect at least the above functions, irrespective of whether they have any other relation with Bank.

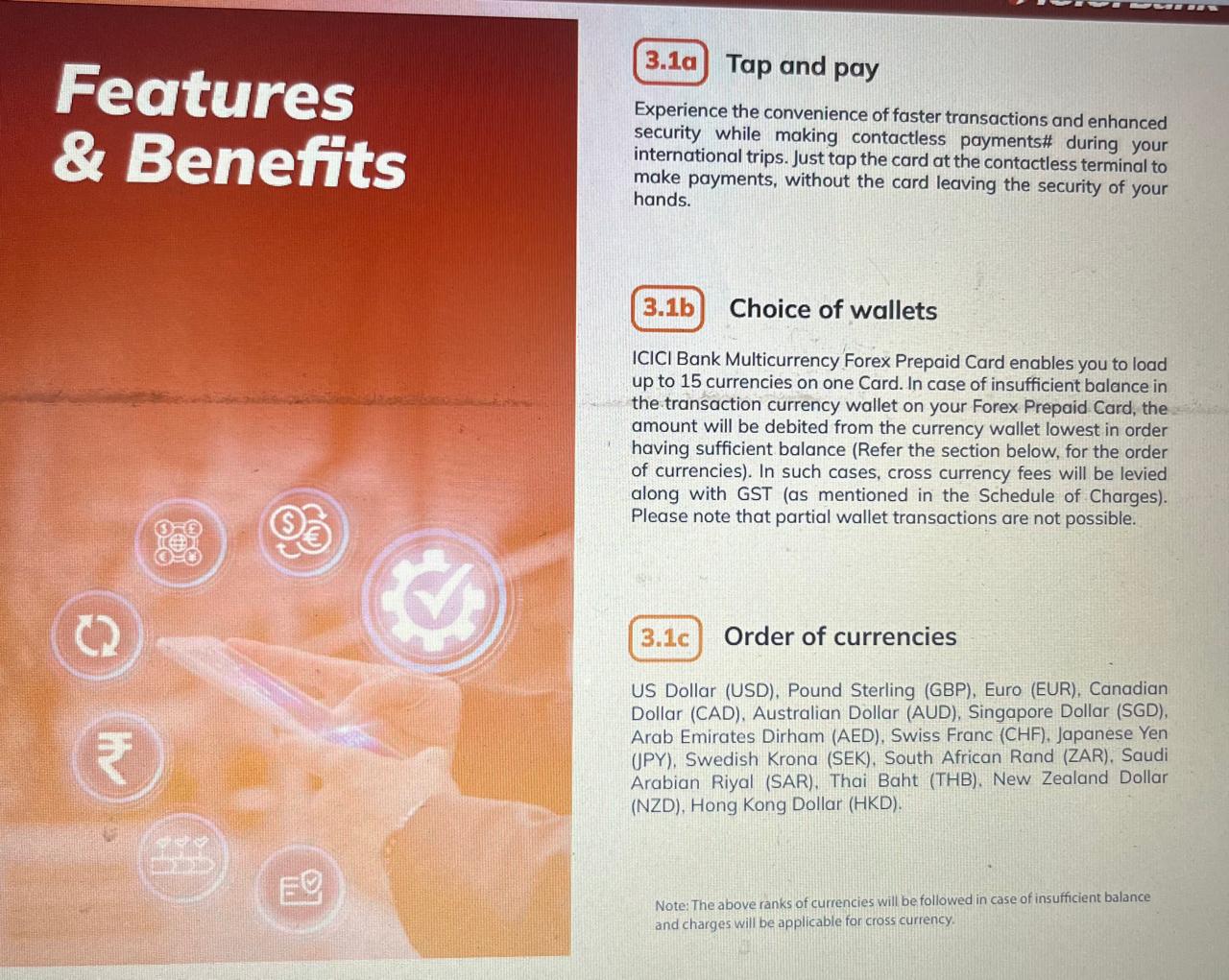

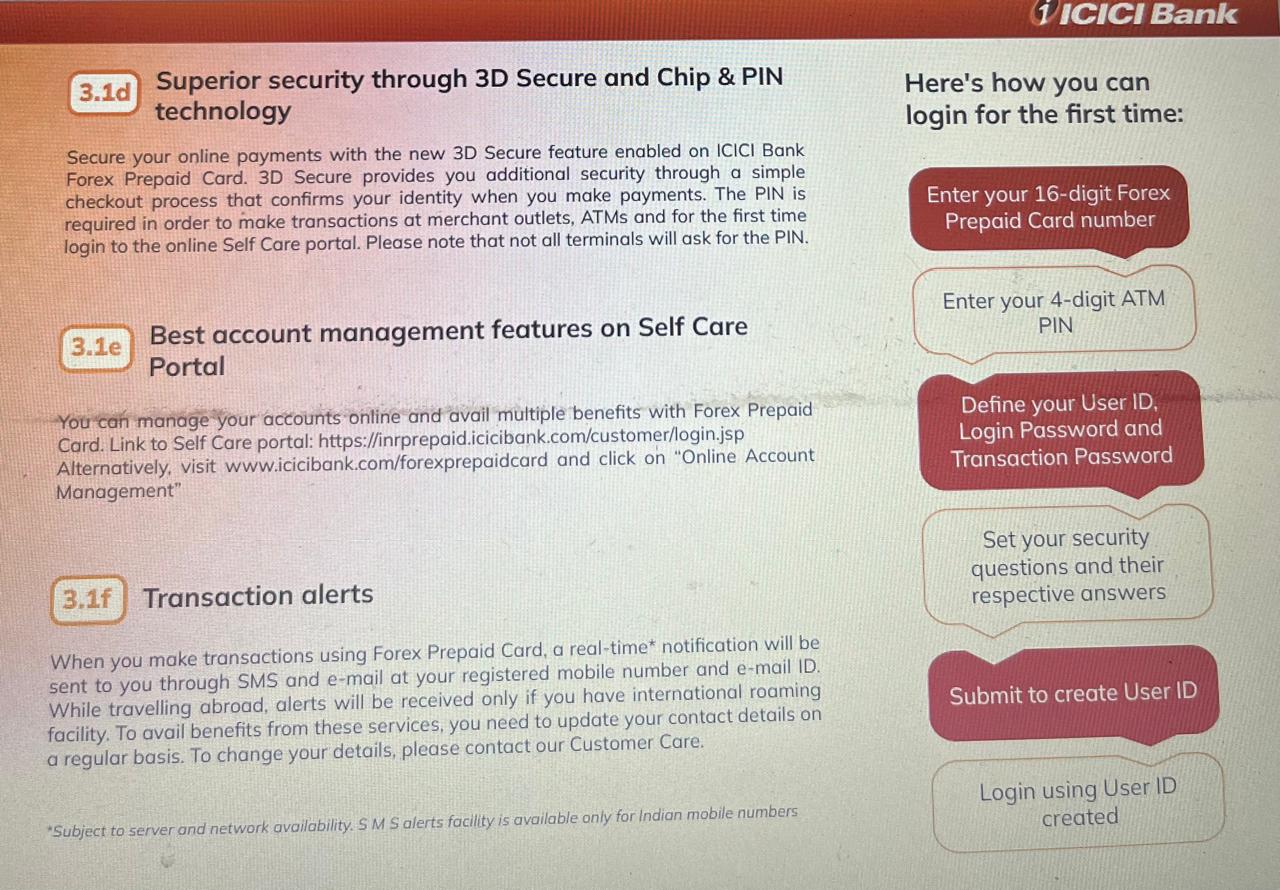

There are no dedicated resources in the bank website or on any channels that highlight our product's features and benefits from corporate perspective. There is a user guide from cardholder perspective, but not specific to business travel:

Since the purchase decision of our product is firms thereby making it a B2B offering, even to date, we do not advertise corporate forex in the scale retail forex is advertised. However, there could have been relevant information on our website or other platforms, to highlight, or the least incite conversation regarding our offering. The only conversation that could be found online regarding corporate forex were 2 issues that cardholders highlighted. There is no further comment or conversation after customer support said they will assist.

Our revenue comes from our card network VISA on the spends we make (primary) & the charges we collect from customer (minor component, especially in corporate forex where load, reload, annual fees are waived off since volumes are there).

Existing Solutions in Market

Broadly, there are two alternative solutions available:

Corporate credit card - This is probably the first solution that emerged to address the funding need for corporate business travel. It is still prevalently used as well. This can be used for travel needs within India as well, since the limit set will be in INR. For international travel, the amount will be dynamically converted every time there is a spend. The conversion as well as charges are on the higher end, cash withdrawal is a very expensive option, which is one of the reasons to explore pre-loaded or foreign currency wallet solutions.

INR prepaid card - This solution gained visibility within our client base, around the same time when Forex prepaid corporate cards were being launched. This is predominantly used in travel within India. It has very low penetration for international travel (but no restriction as such), since dynamic conversion rates still apply and overall the solution was still quite expensive.

Understanding Core Value Proposition

Our main benefits are choice of offerings we provide to service the need. Corporates who already have a relationship with our branches are managed in a de-centralized mode, where their existing accounts are leveraged for loading the cards. One key advantage is that our extensive branch network enables to service cardholders even in remote locations, albeit the corporate may be based out of a city. But since servicing is restricted to branch timings, alternately there are corporates we manage directly as well as via agencies. There is choice in if the fund will be pre-loaded from their account or if they want a credit limit. If it is via a credit limit, then subject to corporate negotiations, potential & eligibility, credit parameters are decided. (Example: decision on interest free credit period). About 35% of our portfolio remains inactive across channels, however we could activate up to 7% of passive clients, via finding a more relevant servicing channel for them.

Dedicated relationship managers manage large corporates, with the expectation that there could be adhoc requests or customised offering that may have to be provided. Doorstep delivery would be facilitated, depending on corporate request. The experience, existing relationships that Bank has with large corporates benefit the firms also in negotiating better deals & making use of the existing platforms to meet more needs. 55% of our large corporate onboardings were sourced from other products within Bank. To some extent, our brand value and being a Bank gives confidence to some of the firms to take credit line and then repay us back, as compared to the same offering provided by a non-Bank entity. About 4% of our onboarding portfolio were leads who our teams touch-based with, when they did not want to continue direct engagement further with the agencies.

Some of our big clients who onboarded with us, highlighted the pricing in our proposal being the final deciding factor for them (as compared to other Banks who gave them a proposal). But this is a variable, and not really a unique feature of ours. Subject to potential and criticality of their existing or future relationships, this varies. Also, in many cases, there are authorized sellers who sell at a discounted price than ours.

The negative experiences shown for issuance and card load or reload have an effect on cardholder experience too. Currency component eats into our margin and is allowed with a capping only. Technical issues with regards to API or service failures (Example: Live photo authentication error) cause bottlenecks and impact TAT of these actions. Card declines, although at times can be at card network end, still affects customer experience heavily for us. There are some complementary benefits given to cardholders of our large corporates, such as Uber voucher & international e-SIM. The only communication found online for ICICI corporate forex are the snaps attached below. There weren't any conversation otherwise for business travel per se; this could very well be because the decision or funding is not done by them.

Amongst cardholders, not a single reddit thread on forex card seemed to include ICICI corporate forex solution. But this was not a shocker, considering users are not bearing the cost or making purchase decision for us.

Understanding the Users

In our product's case, the decision maker is the corporate entity in the larger sense and most often the directors of the institution. End users are all staff who travel abroad with our forex cards.

Scenario 1: Cases where we get the lead via internal relationships

Influencer in such cases are the corporate FPRs who have either dealt with at least one other corporate product of ICICI. They would have heard an initial pitch and further connected our team with more stakeholders.

There are 3 types of blockers we have encountered in this category:

- Blocker can be the finance head, who may negotiate further or define deal-breakers, without which the contract will not proceed ahead. Subject to P&L check at our end, further decision is taken.

- Blocker can also be a regular traveller working closely or part of senior management., who has been using forex card of another entity and is really satisfied. Here, more than tangible features, it is loyalty & intangible features that really seem to hold the fort.

- At times, the regular traveller using card (forex or other solutions) from another entity may point out certain features or aspects that cannot be provided or serviced through our product.

Scenario 2: New onboarding to the Bank

In this scenario, our influencer is likely to be finance team. Whenever a fresh proposal is shared with no prior history of engagement, the most probable first party asked to check & take this further is this team.

Blockers in this category are same as that of 2 & 3 mentioned above, a key decision maker who is a satisfied customer of another entity and/or solution. Either no tangible features are communicated, but there will be resistance or there may be specific functionality gaps with our product.

Scenario 3: Servicing via authorized dealers or third party agencies

In certain instances, influencers are the agencies who are onboarded with us via a seller agreement. i.e., the corporates would not have been directly engaging with us, but would be using our cards sold by agencies to them. Blockers are the competition cards sold by such agencies to them (we are one amongst many cards they deal with)

There is one incidental sub-scenario that emerged from this arrangement: Few corporates have reached out to us, expressing interest in dealing directly with us after using our cards.

- One blocker, albeit rare, in this scenario is our internal compliance team, wherein we may not be able to onboard due to RBI guidelines or pre-requisites not being met.

- Another is my own team (product), who may have to assess P&L to see, if the currency component or waiver benefits provided by agency could be matched by us.

Understanding your ICP

B2B Table:

Criteria | ICP1 | ICP2 |

|---|---|---|

Name | Robert Bosch Engineering & Business Solutions Pvt Ltd | Air India Express Limited |

Annual Forex Potential (In US Dollars equivalent) | 45 million | 10 million |

Top 3 currencies | GBP, EUR, USD | AED, USD, EUR |

Industry Domain | Engineering | Airlines |

Stage of the company | Matured scaling | Matured scaling |

Cardholder count | 12000+ | 2000+ |

Organization Structure (From POV of decision-making for our product) | De-centralized (But, seems to be on a trajectory to centralized) | Centralized |

Decision Maker | Finance Department | Directors |

Decision Blocker | Competition cards sold by agency | Finance team (at this stage, re-negotiated waivers with them very recently) |

Frequency of use case | Monthly | Monthly |

Other products of Bank | Demat accounts | Salary & wealth accounts |

Time taken for activation (our average benchmark value is 3 months) | 3.5 months | 2 months |

Annual volume in USD | 20.7 million | 6.3 million |

ATM % (Very low revenue, with no waivers) | 22% | 40% |

Growth of company (POV of travel needs factored in) | Low | Low to Medium |

Organization culture | Low to moderate on experimentation | Less experimental |

Note: The values highlighted in red indicate they are in non-desirable range for that parameter.

The following is the ICP prioritization table that helped in choosing the above 2 clients. However, I have listed the criteria as per priority (1st row being the highest priority factor) and tweaked as per the context:

Criteria | ICP 1 | ICP 2 |

|---|---|---|

Frequency of Use Case (Active on all months) | High | High |

TAM in INR (Annual corporate volume * revenue made per dollar of volume) | 46.5 million | 9.46 million |

Distribution Potential (Customer base being the context) | Very High | High |

Appetite to Pay (No direct payment applicable from clients, context here is appetite to bear charges and rates) | High | Medium |

Adoption Curve (Time period from onboarding to actively getting load requests) | Slow | Moderate |

None of my top 5 customers were pull customers. (Only 1 out of my top 10 is a pull customer) We had to push our product through proposal meetings & follow-ups to get to activation. Once activated, scaling up has been low effort for the top 5. All of them have high engagement levels, & this is pivotal to our profitability. However, there has not been any instance of a client onboarding, through a referral from an existing corporate client. We have not encountered any scenario, where corporate referral has come up as a potential channel for our solution.

The core value then becomes providing forex card for business travel to frequently flying large-scale organisations.

Understand Market

Since the product is also in a matured stage, we have several competitors who have travel card related solutions for corporates. Hence, the users remain same across the competitors:

Factors | Axis Bank Corporate Forex | Thomas Cook Corporate Forex | HDFC Bank Commercial Card |

|---|---|---|---|

What is the core problem being solved by them? | Ease out international travel transaction management for corporates & provide funding choices /support (Axis is the most mature bank in this space & has been able to prioritize travel management for corporate on a higher scale) | Ease out international travel transaction monitoring & provide the best pricing deals (Since in-house funds are not available to them, providing cheap credit is not an option. However, their pricing deals are too good and are difficult to match) | Management of all business expenses & business-related payments. Here, travel is only one of the components amongst many and within travel, these are used for domestic & international travel |

What are the products/features/services being offered? (In comparison to us) | Specific reports pertaining to GST for firm, integration with firm's internal transaction management systems, INR wallet also possible. | Way more lenient with cash component, ATM fees waived off, one lounge access with the card. Reward program for travellers in trip related bookings. | Being a credit card, there are much better rewards with spend. Repayment period seems to provide a net higher period in relation to forex cards with credit line. No refund needed, & repayment automation. |

GTM Strategy | Targeting: Using corporate forex as a channel to bring large corporates into Bank, Much larger penetration in exports related firms Marketing Channels: Personalised pitches, client events & email marketing Sales channels are same as ours (branch, central relationships, via authorized dealers). Since they are more matured, the key metrics for success could be measured via revenue, net promoter score. | Targeting: Small to medium corporates are targeted more with their best offering (we service such firms too, but we are very restrictive on the offering & pricing.) Marketing channels: Their social media page (LinkedIn) & channels like WhatsApp, to circulate crisp content including videos. Their website is probably the only one that explicitly highlights corporate forex with a decent summary Sales channels for their products are through their PAN India offices. They also act as a distributor and sales agent for other banks’ cards | Targeting: Large corporates who already have relationship with the Bank, or internally or externally rates clients, are likely to be the target, since unsecured line of credit will be issued. Marketing channels: Social media channels like YouTube and Facebook, had ads. (But unless I explicitly specify HDFC in my search word, their card was not in top search results). Website has also decently captured the overall solution and card variants within this solution (However, this basic hygiene was followed by other main players offering commercial cards too) |

What pricing model do they operate on? (Extras or not part of income, when compared to ours) | Being a Bank, they have flexible funding options including providing credit. Premium pricing approach is followed. Amongst fee components, encashment fees is extra component, for any scenario of foreign currency to INR conversion. Every other component and value are also matched. | They have to either take credit from banks (cost of fund would be high here) or take advance payments from corporate. They probably chose recycled cards & is advertising this aspect a little extra to widen scope of corporate funding via CSR or ESG channels. Since they do not have an ecosystem to cushion the acquisition costs in corporate forex, they have penetrative pricing. Out of fee components, inactivity fee seems to be extra (assuming this is applicable to corporate cardholders too) | Being a Bank, the cost of fund to provide credit is low. Premium pricing approach, in line with the premium solution expectation. Fees & headers are different from prepaid and more similar to credit cards (for example, late payment charges, payment return charges, reward redemption fee etc.); fee income is a bigger revenue here as well. |

Brand Positioning | An experienced service provider that can service very large corporates’ forex needs | An innovative service provider that can provide personalised service and improve ease of usage for business foreign travel | A trusted partner for businesses ranging from small to large corporations, for end-to-end management of business expenses |

UX Evaluation | Technical platforms – Better than ours, especially for large corporates that are centrally managed Overall user experience- Our branches have been able to service customers better, but we started onboarding centrally managed large corporates only last year & are very much in early growth stage (specific for this channel) | Technical platforms – best amongst all forex prepaid card players. Cardholder experience is rated quite high (higher than us). Unsure of how their target corporates are rating the overall solution at this stage. Not many large corporates are yet considering them as a potential option. | Technical platforms – provision of detailed reports and paperless claims (which is more in par with our commercial card too, bit our solution for corporate forex in this regard is WIP). Issues regarding management through multiple systems seems to be a common challenge between us. Overall user experience is higher, owing to rewards system and many variants within this umbrella category |

What is your product’s Right to Win? | Our extensive branch network and stronger commission model with agency, at this moment. While we are making our footprints grow in other channel(s), the above 2 are more nuanced for us. | Flexibility in funding, Bank’s brand value & experience in dealing with large corporates, our ecosystem helping us provide complementary insurance for all cards | Bundling of cash component & much lower cost for cash withdrawal. Overall also, lower charges / fees, including minimal to no dynamic conversion charges |

What can you learn from them? | Rate of growth within large corporates & how their high net-worth individuals are leveraged to get entry points into individuals’ firms | Owing to years of experience as a seller and dealer of bank cards, they were very well-versed with distribution & implementation strategies: this definitely gave a good leeway for them to venture into corporate forex, with their own cards. Their communication & outreach activities have also been far better than ours. | For corporates we are proving credit line, we can definitely look at adopting better credit periods (our proportion of unsecured credit is also lower). How rewards can be better given, but not at all in the scale or form commercial card is able to give; at least if we can incentivize spends via our own card or have better co-branded solutions, we will have better proposition. |

At a macro level, we are late entrants to focused approach on corporate forex, primarily because we presumed there were other products that were offering solution to this problem (as mentioned in existing solutions). The rate of growth of Axis in the space was one main nudge, plus our corporates who were serviced via branches (of smaller scale) although provided us consistent incomes, had reached stagnation in terms of growth rate. This led us to explore other avenues and models for expansion of this channel. In line with providing rewards and competing with commercial cards, we could explore co-branded cards for business travel.

Estimating Market Size

Considering all registered private, public limited & limited liability companies, the total count of potential customers is taken as 17.3 lakhs. The current average monthly load volume & net revenue per 1 USD load for us, considering weighted average of all channels is ~ 9700 USD and INR 2.3 respectively.

This brings our monthly TAM to INR 38.59 billion.

Our existing corporate base (all the other products, including inactive ones) comes to about 2.75 lakhs. If I factor in the rated clients which are not yet onboarded (Taking CRISIL as reference and considering AAA to B as band), the count comes to about another 1.25-1.5 lakh firms. This brings market segment count to about 5 lakhs which is about 30% & hence, the monthly SAM to INR 11.57 billion.

As per VISA’s data for last FY, our market penetration is about 18% in corporate forex space. Note: There may be other card networks, used by other entities & hence, taking market penetration to be 16%. This brings our monthly SOM to INR 1.8 billion.

Designing Acquisition Channel

Channel Name | Cost | Flexibility | Effort | Speed | Scale | Budget |

|---|---|---|---|---|---|---|

Organic | Moderate | Low | Low | Very low | Very low | Nil |

Paid Ads | Low-moderate | High | Moderate | Moderate to High | Moderate to High | Low-moderate |

Referral or Partner Program | Low | Medium | Moderate | High | High | Low |

Product Integration | High | Low | High | Low | Moderate | High |

Content Loops | Low | High | Low | Very low | Low | Low |

Detailing your Acquisition Channel

Paid Ads

CAC: My advertisement cost come around the range of 80k-90k, I will consider 85k. Total corporates expected to onboard PAN India from such an advertisement is 5 – This makes my CAC INR 17k. LTV for my customer would be Avg. load value * Net revenue per dollar * no: of months the customer retains. This becomes 9700 * 2.3 * 36 = 803160.

My CAC: LTV ratio is 0.0211. This is a validation that my product has reached the right stage and scale to consider advertising via paid ads. Also, the main channel of 1:1 pitches and tapping Bank’s existing relationships used as on date, definitely will keep being tapped – just that the conversion TAT is quite high in this case. There is no incentive that we are able to offer for urgent action.

LinkedIn will be chosen as the primary channel since there is a scope of interaction with the corporate entities. On any other channel, audience is likely to be end users, who may not be the decision maker. Especially since, we have not done paid ads for corporate forex and our ICPs have a centralized, hierarchical structure, I believe our primary focus should be to get to companies only.

Creative strategy:

In case of video, the first set of clips are expected to show staff travelling across airport and reaching an international destination. This is expected to draw attention towards “business travel” theme. The video will be byte-sized (not more than 1 minute) and include formal setting to fit into LinkedIn platform. The conversation would be starting with asking if the firm ends up spending too much on business travel, in the form of charges / rates or faces issue with setting spend limits & tracking spend. The solution would quickly summarise the benefits to corporate and cardholder via the sample points mentioned below.

In case of written creative, the structure followed would be problem statement – solution for corporates – solution for cardholders summarized into a single page.

In case of written creative, the structure followed would be problem statement – solution for corporates – solution for cardholders summarized into a single page.

How the campaign will run?

We would choose 1-2 of our agency partners to circulate this in their respective LinkedIn pages too, for higher impressions. The description in both cases would invite corporates to express interest (& mention the entity from where they saw/got the link), after which ICICI Bank would email the proposal and map a relationship manager to take forward discussions with corporate. There will be a coupon code to get waiver for ATM fees in the first quarter of onboarding, which will come with an end period of 30 months. Source of each such click was captured for the commission payment to agencies in case a successful lead got generated.

Referral Program/Partner Program

Referral program is not an approach that would work for us, considering our B2B clients do not seem to have much of an interaction with each other, especially around our product’s scope. Partner program on the other hand is something we already have in a slightly tweaked manner & is the largest channel bringing in business (Meaning, they sell our cards and we give a commission, but these are agencies authorized by RBI to sell forex cards implying, this is their primary operation). But, how can we go about scaling this up?

One new entry point could be to identify travel agencies doing business booking for our target segment and make them our partners. Usually, organisations have a committal relationship with such agencies and they could help in routing consistent travel requests to us. There are two layers of revenue here: One the agents (staff of such an entity) travelling along with this group or any other group of leisure travellers can avail our card, Two the clients who are doing bulk bookings for business travel can be referred with our card. In the second case, they will not be direct sellers, but lead generators for us. Depending on the volume they bring in, payout and waivers can be negotiated. There will be milestone based additional payouts, for crossing volume milestones.

Assuming, there is a corporate portal through which booking is initiated at client’s end, we would want a prompt at the end of booking, to ask if clients already have a corporate forex or are looking for a new offering. This data would also help us to know about the scope of client and if further reach-out is required. Partners can share this data with us (ideally via API integration, but from a MVP angle, we can get the reports via mail first).

The message would be a prompt asking

“Are you looking for a Forex card solution to meet your travel requirements?” & show the summary slides as given in Image creative above.

A reference no: will be generated against Yes responses which will be the identifier at our system and their portal. The status of onboarding and sale of cards will be updated against the reference no: for tracking purpose and informed to partner (subsequently through callback APIs). And this data will be an input for lead generation payout.

Since the journey of client within corporate portal ends there, further proposal sharing and communication would be initiated from our end to client directly. The partner on our behalf can also share the details with client and intimate us to then take the same forward. Reference IDs and corresponding lead statuses will be sent in the same way to partner. (In API use case, we will accommodate request asking for live status from the partners as well)

Any staff of the partner using our card will be part of our repository and would be used to generate reports, that will again be input for commission / incentive payout.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.